Understanding the Difference Between Life Insurance and Term Insurance

Life insurance is a broad category encompassing various policies designed to provide financial security to beneficiaries upon the policyholder’s death. Within this category, term insurance stands out as a specific type of life insurance with distinct features and benefits. This article delves into the key differences between life insurance in general and term insurance, helping you make informed decisions about your financial planning.

What is Life Insurance?

Life insurance is a financial product that offers a payout to beneficiaries upon the policyholder’s death. The primary purpose is to provide financial security and peace of mind, ensuring that dependents and loved ones are taken care of after the policyholder’s demise. Life insurance can be broadly categorized into two main types: term insurance and permanent insurance. Permanent insurance includes whole life, universal life, and variable life insurance.

What is Term Insurance?

Term insurance is a type of life insurance that provides coverage for a specific period, known as the term. This term can range from one year to 30 years or more. If the policyholder dies within the term, the beneficiaries receive the death benefit. If the policyholder survives the term, the coverage expires, and there is no payout.

Key Differences Between Life Insurance and Term Insurance

Duration of Coverage:

Premium Costs:

Term Insurance: Generally has lower premiums compared to permanent life insurance. The cost is based on the length of the term and the policyholder’s age and health.

Life Insurance (Permanent): Has higher premiums because it includes a savings component and provides lifelong coverage. Premiums are typically fixed and do not increase with age.

Cash Value Component:

Term Insurance: Does not have a cash value component. It is purely risk coverage with no savings or investment element.

Life Insurance (Permanent): Includes a cash value component that grows over time. Policyholders can borrow against this cash value or withdraw it, offering a savings or investment benefit.

Purpose and Usage:

Term Insurance: Ideal for temporary needs, such as covering a mortgage, funding children’s education, or providing a safety net during specific life stages. It is suitable for those seeking affordable coverage for a set period.

Life Insurance (Permanent): Suitable for long-term financial planning, including estate planning, retirement savings, and providing lifelong financial security for dependents. It is a tool for those looking for both protection and a savings/investment vehicle.

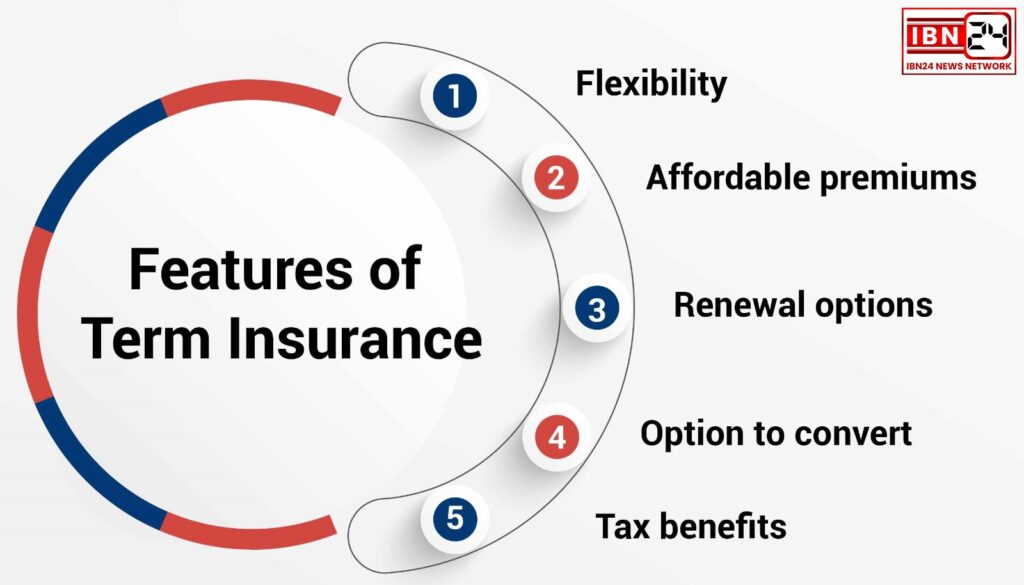

Flexibility:

Term Insurance: Less flexible, with a fixed term and no cash value. Some policies offer the option to convert to permanent insurance, but this typically comes at a higher cost.

Life Insurance (Permanent): More flexible due to the cash value component and the ability to adjust premiums and death benefits (in some types, like universal life insurance).

Term Insurance: Offers coverage for a fixed period, such as 10, 20, or 30 years. Once the term ends, the coverage ceases unless renewed.

Life Insurance (Permanent): Provides lifelong coverage, lasting until the policyholder’s death as long as premiums are paid.

Benefits and Drawbacks

Term Insurance:

Benefits:

- Affordable premiums.

- Simple and straightforward.

- Suitable for short-term needs.

Drawbacks:

- No cash value or savings component.

- Coverage expires at the end of the term.

Life Insurance (Permanent):

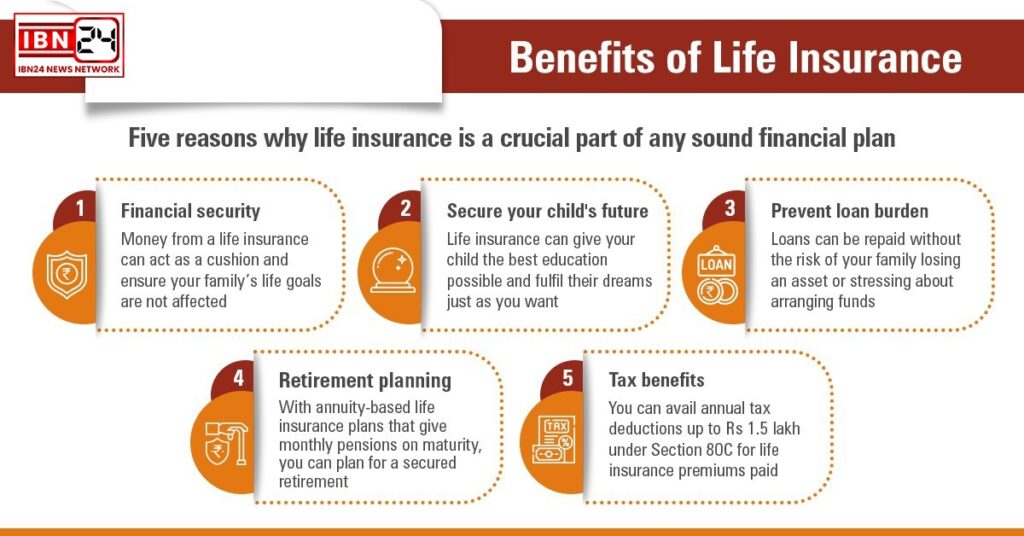

Benefits:

- Lifelong coverage.

- Cash value component provides savings/investment opportunities.

- Fixed premiums (in whole life insurance).

Drawbacks:

- Higher premiums.

- Can be more complex to manage.

Choosing the Right Policy

Deciding between term insurance and permanent life insurance depends on individual financial goals, needs, and circumstances:

- Temporary Needs: If you need coverage for a specific period, such as until your children are financially independent or your mortgage is paid off, term insurance may be the best option.

- Long-Term Security: If you seek lifelong coverage and the added benefit of a savings component, permanent life insurance is more suitable.

Assess your financial situation, long-term goals, and budget to determine which type of life insurance aligns best with your needs. Consulting with a financial advisor can also provide personalized guidance tailored to your specific circumstances.

Conclusion

Understanding the differences between life insurance and term insurance is crucial for making informed financial decisions. While term insurance offers affordable, temporary coverage, permanent life insurance provides lifelong security with additional financial benefits. By carefully evaluating your needs and financial goals, you can choose the policy that best protects your loved ones and ensures a stable financial future.

Income Tax Return: ITR फाइल करते समय न करें ये 10 गलतियां, आ जाएगा नोटिस